As fiscal support is gradually phased out, global corporate insolvencies are forecast to increase by 26% in 2021

Summary

- Corporate insolvencies continued to decrease in 2020, despite the sharp decline in GDP. This discrepancy is driven by temporary adjustments to insolvency laws and fiscal support packages.

- As support measures are phased out, global corporate insolvencies are forecast to increase by 26% in 2021.

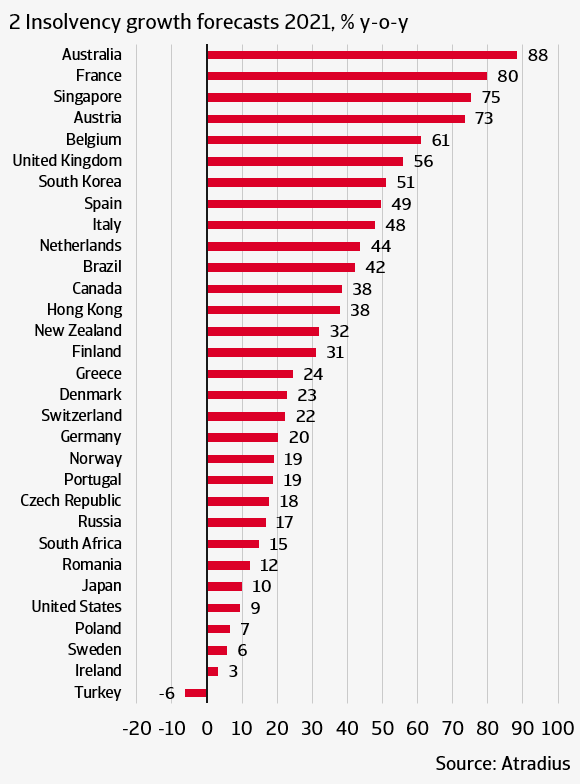

- The percentage increase of insolvencies in 2021 is highest in Australia, France, Singapore and Austria, all countries that had strong government measures in place in 2020. As these measures will be gradually phased out, this will drive insolvencies up.

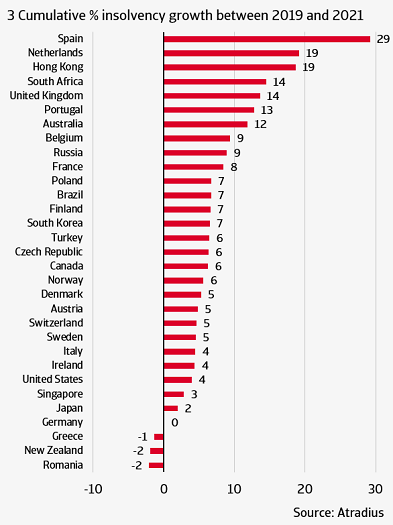

The widely anticipated rise of business insolvencies did not occur in 2020. Global insolvencies are estimated to have declined by 14% in 2020. This is likely to be followed by a 26% rise of insolvencies in 2021. The increase is expected to take place in all major regions and countries, except Turkey. This upward trend is not surprising, as we expect that the temporary measures that kept insolvencies unusually low in 2020 (insolvency law amendments, fiscal support) are gradually phased out in 2021. The level of bankruptcies at the end of 2021 will be higher in virtually all markets than it was in 2019.

The pace of economic recovery in 2021 varies significantly around the world

After a year of global recession, 2021 is bringing new hope as the recovery will set in. Global GDP growth is estimated at 6.0% in 2021, after a 3.7% contraction in 2020. The rollout of vaccines is underway, and positive trial results should boost vaccine availability as the year progresses. While global growth in Q1 of 2021 is likely to remain modest due to activity restrictions in order to bring Covid-19 numbers down, an acceleration of GDP will take place in the rest of the year.

However, there are still risks to this outlook, mainly linked to the evolution of the pandemic and the success of vaccination campaigns. New Covid-19 infection cases remain high in some countries, such as Brazil, France, Italy and Turkey. While vaccination has started almost everywhere in the developed world, the pace has to accelerate in order to get a substantial part of the population vaccinated by the end of Q2. In this respect Israel is ahead of other countries, already experiencing a substantial drop in new Covid-19 cases and tangible reductions in hospitalisations. The UK and the US are also doing better than average. In Europe the rollout is still slow in many countries and needs to accelerate in order to get a substantial of the population vaccinated by summer.

The pace of GDP recovery in 2021 varies significantly around the world. The eurozone witnessed a 6.8% GDP contraction in 2020, but with a moderate 0.7% quarter-on-quarter GDP decline in Q4 it coped better than expected with re-imposed Covid-19 restrictions. While it is likely that ongoing lockdowns and the slow start of the vaccination rollout will lead to a double dip recession in Q1 of 2021, there is light at the end of the tunnel. As vaccination programmes gain momentum and the pressure on health systems subsides, containment measures are set to relax gradually. This should lead to an economic recovery as of Q2, bringing Eurozone GDP growth to 4.2% in 2021. Countries that experienced the deepest recessions in 2020 will generally witness the strongest expansion in 2021. Several factors determine the strength of the economic recovery. First, the stringency of lockdown measures and the speed at which they can be reversed. Last year´s lockdown measures were relatively stringent in Portugal, Italy, Spain and Ireland, which led to low consumption of services in those countries. In comparison, less stringent measures could be found in the Netherlands, Austria and Finland (although in the Netherlands measures were tightened considerably towards the end of 2020). The reversal of containment measures will cause a ‘technical recovery’ in 2021. Countries like Spain, France and Italy can expect relatively high economic growth figures in 2021, while the rebound in the Netherlands and Austria will be lower.

Second, the sectoral composition is also affecting the strength of GDP growth. Due to the importance of tourism for their economies, Portugal, Spain, Greece, Italy and France recorded a strong negative impact on GDP in 2020. As restrictions on tourism and travel are gradually lifted, demand for those services will increase, helping the recovery in those countries. However, tourism flows will not fully recover in 2021, as some people will refrain from travelling to limit health risks. Additionally governments could be reluctant in opening their borders, given that the pace of vaccination differs per country.

The United Kingdom experienced a deep recession in 2020 (-9.9% GDP) due to strict lockdown measures and Brexit uncertainty. In January 2021 the British government imposed a third nationwide lockdown in response to the steep rise in Covid-19 cases associated with the more transmissible variant of the virus. This has placed the economy on a weak footing at the beginning of 2021. The good news is that the UK and the EU finally agreed on a free-trade agreement, limiting the cost of exiting the common market compared to a no-deal. In 2021 we forecast the UK economy to expand 5.9%, which covers only about half of the GDP losses from the pandemic. We expect a meaningful relaxation of lockdown measures as of Q2, as the vaccination programme is well underway.

Outside of Europe, the United States is expecting a strong economic recovery of 7.0% in 2021, a 3 percentage point upward revision compared to our September 2020 insolvency forecast report. The 7.0% growth rate will more than compensate the economic losses seen in 2020. President Joe Biden recently signed a major fiscal stimulus package, the American Rescue Plan, which amounts to USD 1.9 trillion (8.3% of the total US economy). Moreover, at the current pace of vaccination rollout the US will reach herd immunity (70% of the adult population inoculated) by early summer. This will ease virus fears and allow for a relaxation of activity restrictions, supporting the economic recovery.

Australia ranks among the best performing developed countries, having the virus effectively under control. Perth’s five-day lockdown in January in response to the detection of one case demonstrates the government’s responsiveness. Australia recorded a relatively mild recession (-2.4%) in 2020, likely to be followed by a 3.5% GDP expansion in 2021.

Japan experienced a 4.9% GDP contraction in 2020, likely to be followed by a partial recovery of 2.7% in 2021. The country experienced a rise of infections towards the end of 2020, triggering a state of emergency. Meanwhile this measure has been lifted for most of the country, except of Tokyo and three neighbouring prefectures, which will remain under restrictions until end-March. While these restrictions will affect the rebound the overall impact will be mild, as the vaccine rollout and stronger growth in the US and China will support economic activity from mid-year onward.

Discrepancy between insolvency development and GDP performance in 2020

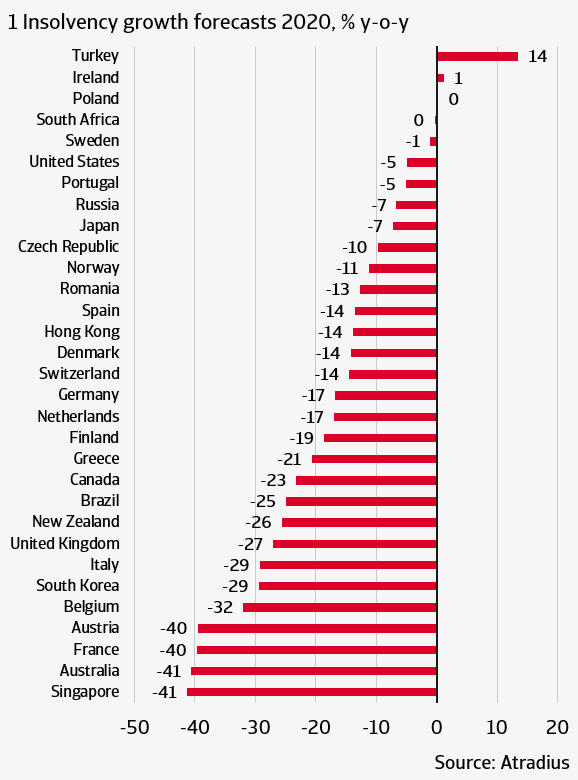

The widely anticipated surge in business insolvencies did not occur in 2020. For most markets the almost complete full-year bankruptcy data is available, which generally points to decreases compared to 2019. Global insolvencies are estimated to have declined by 14% in 2020, with strong decreases in Europe and Asia in particular, and somewhat smaller declines in North America (see chart 1).

|  |

In our previous insolvency report we argued that two types of policies are responsible for the discrepancy between insolvency development and GDP performance. First, most countries made changes to their insolvency regime in order to protect companies from going bankrupt. Second, governments across the world have taken measures to counteract the pandemic-related adverse economic effects and to support small businesses. In Europe, countries like France, Belgium, Italy and Spain enacted laws in 2020 that temporarily freeze bankruptcy proceedings or declare bankruptcies inadmissible. Outside of Europe, Australia has increased the debt threshold for companies to declare bankruptcy. All those countries witnessed a sharp decrease in insolvencies in 2020.

Countries with less sharp decreases in insolvencies often made lesser or no changes to insolvency laws in order to cope with Covid-19, such as Sweden, Denmark, the Netherlands, Ireland, Japan and the United States. Since November 2020 the Netherlands has a temporary law in place under which companies in distress can apply for a temporary suspension of insolvency proceedings and a payments moratorium.

Besides insolvency law changes, fiscal support measures also play a crucial role in keeping insolvency levels low. This assumption is supported by the observation that in some countries with temporary bankruptcy moratoriums the levels of insolvencies remained low even after the moratorium was lifted (e.g. France and Switzerland). Moreover, in Spain bankruptcies showed a steep quarter-on-quarter increase in the last half of 2020 although the insolvency moratorium was still in place. The most effective form of government measures are direct fiscal spending and tax breaks (classified by the IMF as ‘above the line’ fiscal measures, in contrast to ‘below the line’ measures, such as loans or equity injections). European countries with extensive fiscal support measures are Germany, France, Austria, Belgium, the Netherlands, and the UK. Outside of Europe, the United States, Canada, Australia, and Japan have all implemented substantial fiscal support packages, contributing to very low insolvency levels in 2020 compared to GDP contraction. Turkey and Ireland are the only observed markets with an increase in insolvencies in 2020. For Turkey, this is clearly the result of weaker government support, while in Ireland no adjustments to the insolvency framework were made in relation to Covid-19.

Business insolvencies expected to increase 26% globally

In 2021 the picture of declining insolvencies will completely turn around, as we expect that fiscal measures and insolvency law amendments will be gradually unwounded. This will push global insolvency growth to 26% in 2021, with increases across all major regions and countries (see chart 2). Bankruptcy moratoriums are expected to expire in the first half of 2021. In Austria and Finland the suspension of normal bankruptcy rules expire in Q1 of 2021, while Australia returned to normal bankruptcy procedures on 1 January 2021. The Netherlands extended its moratorium until April 2021. In several countries, fiscal stimulus packages are currently being extended until Q2 2021. After Q2 2021, a more significant relaxation of containment measures is expected, resulting in a phasing out of fiscal support and a lifting of bankruptcy moratoriums.

Three forces shape the 2021 insolvency forecast

A first force shaping the insolvency forecast is the delayed effect of bankruptcies that under normal circumstances (no fiscal package, no insolvency moratoriums) would have occurred in 2020. We assume that parts of those bankruptcies will materialise in 2021. Countries that ‘saved’ many firms from bankruptcy in 2020 will see a relatively strong carry-over of bankruptcies into 2021, upwardly affecting the insolvency forecast for 2021. This is expected to happen in a number of markets that provided temporary adjustments to insolvency law and extensive fiscal support, such as Belgium, France, Austria and Italy. Outside Europe Australia and Singapore are examples, as in those markets there is a delay of insolvencies from last year to this year. For Sweden and Ireland we expect a lower effect of delayed insolvencies from 2020, as in both countries there have been no major changes to the insolvency laws.

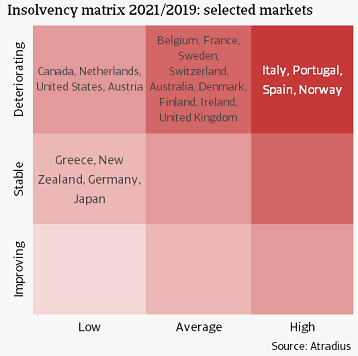

A second force is the increase in insolvencies due to economic conditions, which depends two factors: the strength of economic growth in 2021, and how responsive insolvencies are to GDP growth. In some markets (Austria, Spain, United Kingdom), the recovery is weak compared to the 2020 contraction, which leads to upward pressure on insolvencies. In other markets the recovery in 2021 is relatively strong (New Zealand, Canada), generating a downward pressure on insolvency growth. Regarding sensitivity of insolvencies to GDP growth, this ‘elasticity’ is high for instance in the Netherlands, Spain and Australia. As a consequence, we see a rather strong cumulative increase of insolvencies in between 2019 and 2021. The high elasticity of insolvencies to GDP growth in the three markets is the result of the rigidity of the bankruptcy laws, which are very creditor friendly. However, Spain has implemented some reforms in 2014 that incentivize companies experiencing difficulties to opt for restructuring instead of liquidation. Both the Netherlands and Australia have reformed their bankruptcy laws in 2020. In the Netherlands, a new bankruptcy law will make it easier to restructure a company outside a formal bankruptcy procedure, and Australia implemented reforms that try to achieve the same. Both Australia and the Netherlands draw inspiration from US Chapter 11 insolvency framework (with the Netherlands additionally from the English scheme of arrangements). This could change the elasticity of bankruptcies to GDP growth in the future. The same could to some extent apply to Spain, but there the reforms have been less fundamental.

As a third force shaping the 2021 insolvency forecast, fiscal support matters. We expect government support schemes to be continued in the first half of 2021, but quickly phased out in the second half, when a large part of the population in developed markets is vaccinated. We therefore assume that fiscal measures will apply to roughly the first half the year only.

On balance, these three forces translate in a year-on-year insolvency rise in 2021 in all markets, except for Turkey. Turkey already recorded an increase in bankruptcies in 2020, meaning there is little carry-over of bankruptcies into 2021, and fiscal support has been weak. What plays a role in explaining the strong increases in bankruptcies in 2021 is that the level of insolvencies was particularly low in 2020, due to temporary insolvency freezes and fiscal support packages. This creates a strong upward ‘base effect’. Looking at the cumulative insolvency growth between 2019 and 2021, the level of bankruptcies at the end of 2021 will be higher in virtually all markets than it was in 2019 (see chart 3). This is not surprising, given the strong economic contraction in 2020 and the incomplete recovery in most countries in 2021. For the coming years, we expect that the level of bankruptcies will remain elevated. The phasing out of fiscal support packages and the return to normal insolvency procedures continue to make the business environment very challenging.

Learn more here: https://atradius.ca/reports/economic-research-2021-a-turn-of-the-tide-in-insolvencies.html