10th February 2022ShowSharePrint the page

While the global economic recovery from the pandemic is bumpy, we identify five bright spots for export opportunities

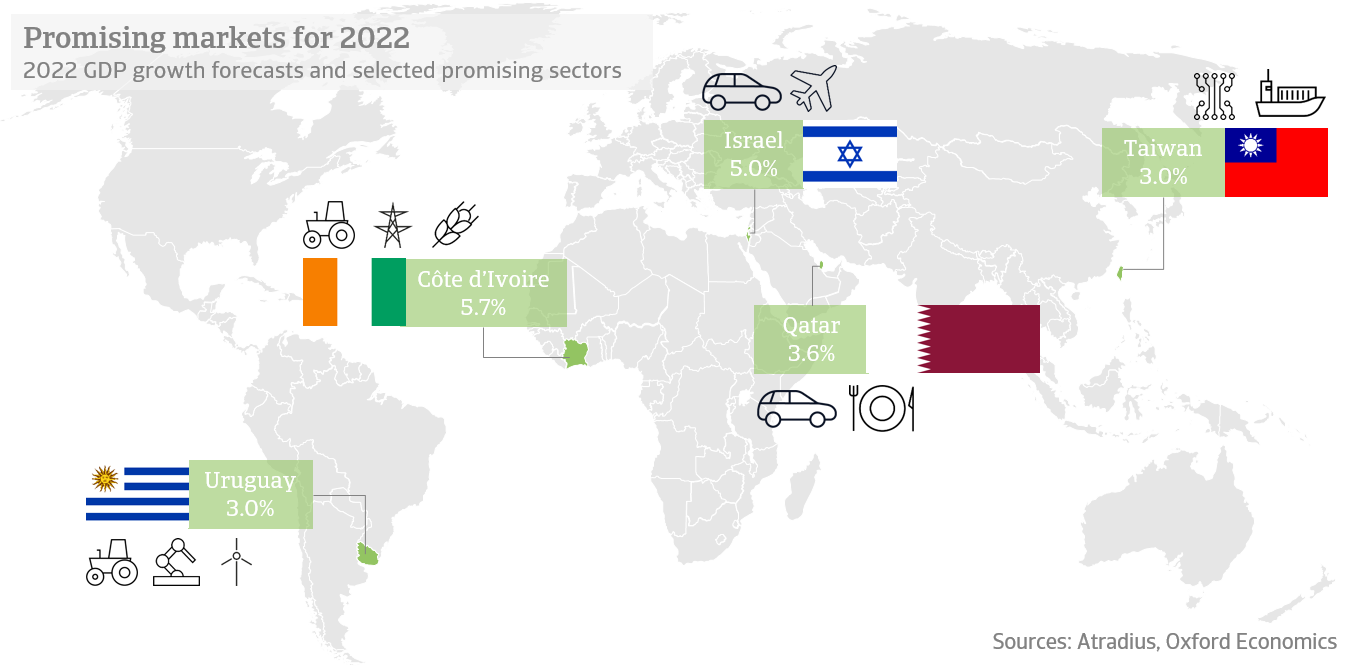

- We identify Uruguay, Côte d’Ivoire, Israel, Qatar and Taiwan as five markets with promising opportunities for investors and exporters in 2022 as the global economy continues its bumpy recovery from Covid-19

- These economies are recovering well from the pandemic and their outlooks are generally well insulated from negative pandemic developments, thanks to extensive vaccination rollouts and/or low infection rates

- The resumption of economic activity is contributing to brighter prospects in the tourism and hospitality sectors while the acceleration of digital adoption for consumers is keeping up demand for transport and logistics

- The global energy transition is also driving policy initiatives in several of these markets, pushing up demand in the renewable energy and electricity sectors, especially for electric vehicles

More than two years into the pandemic, economies around the world are learning to live with it. But the effects of the health crisis and associated government restrictions are increasing volatility while the risk of the emergence of a new, more transmissible variant continues to pose a cloud of uncertainty over the outlook. Supply chain disruptions, soaring inflation and the reversal of monetary stimulus are key developments that are challenging international business in 2022. While the recovery is clearly bumpy, we still see a gradual, prolonged economic recovery this year and next and with it, many opportunities for trade around the world.

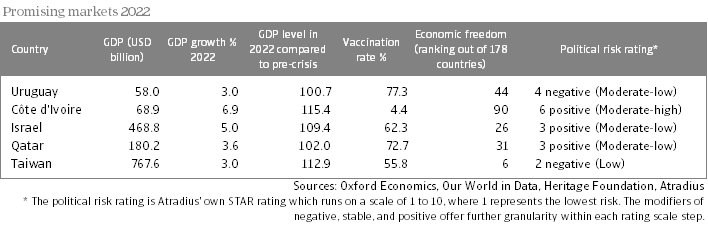

We identify opportunities for trade in 2022 in Uruguay, Côte d’Ivoire, Israel, Qatar and Taiwan. In this year’s edition of our Promising Markets note, we follow a similar methodology to last year but we’ve expanded our country selection beyond emerging market economies and now take into account vaccination rates. The baseline for country selection is three criteria:

- Economic performance: the pace of GDP growth in the wake of the Covid-19 crisis compared to before the pandemic to find growth opportunities;

- Macroeconomic strength: stable political and institutional conditions to facilitate ease of doing business; and the

- Covid-19 situation: the infection rate and vaccination rate, as a proxy for the virus being relatively under control, allowing for economic activity and reducing the risks that the emergence of new variants could pose for that trade.

Alongside our macroeconomic views, we take into account our market experience to also identify industries across these economies with strong growth prospects.

Uruguay: strong institutions and shock resilience

With 3.0% growth in real GDP forecast, Uruguay’s economy will surpass its pre-crisis levels in 2022. Government policies implemented in Q4 2021 including a reopening of borders, the elimination of value-added tax (VAT) for tourists and loans to stimulate the tourism sector – which accounted for 17.4% of Uruguay’s GDP in 2019 – will support growth this year. While Latin America has been the hardest hit region by the pandemic, prioritisation of the vaccination rollout has ensured that 77.3% of Uruguayans are now fully vaccinated. This should support 3.6% growth in private consumption in 2022. Demand for automobiles and electronics in particular is expected to be strong, offering growth opportunities in those sectors.

Next to tourism, Uruguay’s other main sector is food, including agricultural and meat production. Exports in these sectors are expected to grow substantially this year, barring adverse weather conditions, and producers are benefitting from higher food prices. To meet this growth, we expect demand for machinery to support farming activities to be high. Uruguay’s large agricultural sector is however vulnerable to adverse weather conditions though as climate change raises the risk of droughts in the region. In response, authorities are increasingly investing in the renewable energy sector and the country is becoming a major exporter of renewable energy, especially wind-generated, to the region.

Uruguay is also facing rising prices but the country has strong shock resilience. Inflation, at 8.0%, has surpassed the upper bound of the central bank’s current target range of 3% to 7% and is expected to remain above this through the year. The central bank is accordingly hiking interest rates and the tightening cycle may be quicker than expected, depending on US monetary tightening, to prevent peso depreciation and capital. We expect this to remain an orderly process in 2022 thanks to strong institutional quality and a considerable level of international reserves. Uruguay is one of the strongest democracies in the world, with a stable political and business environment, underpinning its robust outlook.

Côte d’Ivoire: robust demand to fuel economic development

Côte d’Ivoire is expected to enjoy some of the highest GDP growth rates in the world over the coming years. With 6.9% forecast in 2022, growth prospects are stronger than the other markets highlighted here. Despite the very low vaccination rate, the economy has fared well through the pandemic and policymaking is offering increasing opportunities. Country risk is elevated with relatively low GDP per capita and high corruption perceptions. But political stability under a pro-business, reformist government, reinforced by a peaceful election in 2021, supports the economic outlook.

An ambitious National Development Plan for 2021-25 aims to improve the business environment through cutting red tape, simplifying the corporate tax code and reducing corruption, while also investing heavily into infrastructure. Côte d’Ivoire is a major agricultural producer, leading the world in exports cocoa beans and cashews. The authorities are also investing heavily to stimulate the quality and quantity of agricultural yields, offering growth prospects in the value-added agribusiness processing sector. Investments to ensure a more sustainable economic growth model and the improving business environment also boast increasing opportunities in the country’s growing IT services and digital economy sectors.

Côte d’Ivoire’s energy sector is another bright spot. Oil & gas is promising with increasing offshore activity, but some opportunity is limited by the introduction of a local-content law that will put additional requirements for local hiring and procurement. We expect renewable energy to offer some of the best prospects for exporters to Côte d’Ivoire as the government works to make the country a regional electricity hub with 42% of electricity from renewables by 2035.

Israel: successful vaccination campaign sustains growth prospects

Israel has stood out recently in the pandemic thanks to a very effective vaccination campaign which has allowed economic activity to continue without serious restrictions. Over 70% of the population has received two shots of the vaccine and it is the first country to start rolling out a fourth dose. This will support economic growth of an expected 5.0% in 2022 after a 6.5% expansion in 2021.

Israel benefits from strong institutions and a stable business environment. These limit the adverse effects of political uncertainty on political continuity. The new government’s reform plan includes structural reforms to boost the labour market and improve the business environment further. Its highly skilled work force and diversified economic base protect the economy from shocks. Israel’s developed economy offers particular opportunities in high-tech goods and services, especially the well-established aerospace sector.

The Israeli transport sector offers bright opportunities, especially in the electric vehicle (EV) segment. Despite being a high-tech country, its adoption thus far of EVs has been marginal. But this is changing as the authorities have announced ambitious plans to have all new cars sold by 2030 be electric. This offers opportunities for exporters of EVs and those that specialise in the associated infrastructure like public charging stations.

Qatar: World Cup boosts investment beyond gas sector

Economic prospects in Qatar are strong, supported by moderately low political risk and an ambitious diversification plan. Qatar’s economy is highly dependent on the hydrocarbon sector which is subject to high volatility. Higher oil and gas prices will support economic growth to the tune of 3.6% in 2022. Qatar is the largest global exporter of liquefied natural gas (LNG), demand for which is expected to remain strong through the global energy transition, as gas is a lower-emission fossil fuel. Output is set to grow substantially with the USD 30 billion North Field Expansion. The renewable energy sector is also increasingly important as Qatar has set the goal of attaining 20% of its energy from solar power by 2030 – although this target is not very ambitious compared to regional peers.

Hosting the 2022 FIFA World Cup will help boost opportunities in the non-oil sector. Tourism and hospitality should experience a strong boost as long as the pandemic remains under control. Moreover, the authorities have started taking serious steps towards electrification ahead of the World Cup but also to meet long-term goals. The transport sector offers bright prospects as Qatar aims to transition 25% of its public bus fleet to electric this year and install 600 charging stations to support them ahead of the tournament. With the installation of chargers, EV adoption is expected to begin picking up as well.

Taiwan’s economy benefitting from global pandemic-related shifts

Taiwan has a strong business climate and its economy has hardly been scathed by the Covid-19 pandemic. The economy is forecast to grow 3.0% in 2022, driven by robust export growth. The outlook for the business environment is positive, supported by good infrastructure, advanced manufacturing capabilities and the high level of innovation, especially in the technology sector. Taiwan is a well-known ICT manufacturing hub and world leader in the production of electronic intermediate goods. With the worldwide chip shortage persisting through 2022, growth prospects in this sector remain bright. Thanks to the global orientation of its intermediate electronics production, the sector is insulated from any domestic restrictions that could be implemented in the downside scenario of a Covid-19 outbreak.

As an ICT hub, high-tech services is an increasingly important sector. Rising demand is driven by the shifting consumer behaviour towards more digital adoption, a trend accelerated by the pandemic. We expect the country’s e-commerce market to grow at a compound annual growth rate of 9.0% to 2024. While not unique to Taiwan, this boosts demand for logistics services and offers growth opportunities in the transport sector.

Dana Bodnar, Economist

dana.bodnar@atradius.com

+31 20 553 3165

Find the full report here: https://atradius.ca/en/documents/atradius_economic_research_promising_markets_2022_ern220201en.pdf