TCI to the rescue 80% of UK manufacturing businesses said it was harder to grow this year than in 2024,

A Defining Shift Toward Global Diversification

Canadian Trade and Budget 2025 Canada’s 2025 federal budget marks one of the most ambitious trade shifts in decades—one that

2026 Global Insurance Outlook

The 2026 Global Insurance Outlook recently released by Deliotte carries the main message to carriers that they “may need to

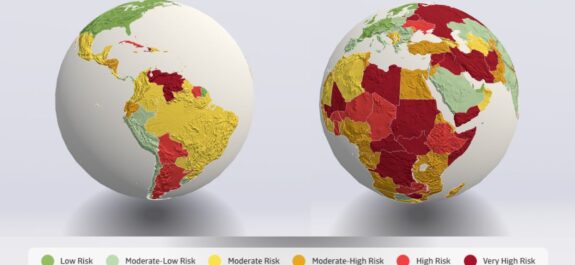

Record level: 2025 political and social risk

It appears that political and social risk is the new norm, according to a new study. The October 2025 Risk

Canada’s competitive edge in European trade

Europe offers a strong international market for Canadian businesses looking to expand internationally. Canada is a key international partner with

Where to Grow

The Canadian government has a goal to double exports to non-US markets over the next 10 years. It will support

U.S Trade & Tariff Cheaters

Some months ago it was announced that the U.S. Department of Justice was preparing to focus on tariff violators, with

Data & Trends in Trade Finance

Trade finance remains a backbone of global commerce. As geopolitics, tariffs, and supply-chain pressures reshape cross-border flows, tools like letters

Foresee Corporate Failures: No crystal ball necessary

Coface, a France based trade credit insurer, has harnessed its investment into supply chain information to add a new revenue

Looking Ahead: Trade in 2026

Exporters may be in for a tough year in 2026, according to Allianz Trade. It has indicated that global trade